The San Diego Lease-Up Blueprint

How Smaller Multifamily Communities Can Achieve Faster Absorption, Higher Rents & Stronger Long-Term Stability

San Diego’s multifamily landscape is evolving quickly. New developments are rising in neighborhoods like North Park, Hillcrest, Bankers Hill, La Mesa, Oceanside, and Chula Vista, creating more choice for renters than ever before. But while large institutional communities often dominate skyline projects, the 150-unit and less boutique properties are the heartbeat of San Diego’s rental market.

For developers, owners, and investors building within this size range, a successful lease-up determines everything: your initial absorption, stabilized NOI, long-term valuation, ability to refinance, pace of cash flow, and resident reputation and brand.

Yet lease-ups for small and mid-sized buildings face a unique challenge: many property management companies are not built for them.

Large firms create lease-up strategies for larger communities - but those same tactics do not always translate to a 19-unit infill project in North Park or a 72-unit mid-rise in La Mesa.

This creates a massive opportunity.

When guided by a boutique management partner, one that understands street-level pricing, micro-market absorption patterns, and the hands-on precision required - small and mid-size properties can often lease and achieve stabilized rents faster than their institutional counterparts.

This is the complete guide to how property management firms like Southwest Equity Partners manage high-performance lease-ups for properties in San Diego.

1. Why Lease-Up Success Matters

A strong lease-up can set your property’s financial performance for years. A weak lease-up can drag NOI down for years. And on smaller buildings, the impact is amplified.

Consider this scenario:

If a 50-unit property spends 90 days at 40% occupancy, you lose thousands in unrealized rent every month and you risk establishing a “vacancy reputation” that is difficult to reverse.

But with a custom lease-up strategy, the outcome can be different with faster absorption, stronger rents, higher quality residents, better reviews, better renewals, and enhanced lender confidence.

The stakes are high and the strategies must be precise.

2. Being Tailor-Made for Small & Mid-Size Lease-Ups

While large property managers operate with playbooks designed for big properties, boutique firms offer several distinct advantages:

Personalized Strategy, Not Templates

Every lease-up is customized based on unit mix, neighborhood demand, competition, seasonality and pricing and incentives.

Faster Decision-Making

The ability to adjust pricing instantly, pivot marketing strategies, modify concessions and respond to issues in real time is an advantage with no corporate layers and less delays.

Micro-Market Expertise

Being local is key. It matters what Bankers Hill residents care about, how La Mesa competes with newer products nearby, and how to optimize studio vs. 1BR demand in Hillcrest.

This hyper-local knowledge directly impacts rent levels and absorption.

Stronger Resident Experience

Creating familiarity and connection, turning early residents into advocates and stabilizing the community quickly will lead to higher renewals and steady revenue in the long term.

3. When to Bring the Property Manager on Board

Developers often wait too long to engage with management, sometimes until 60-90 days before opening. The sooner you can work with a proper manager, the better you will have peace of mind as you approach the final stages of completion.

Ideal Timeline: 6–9 Months Before Delivery

This allows a firm to:

- Build the lease-up plan

- Establish the building’s brand and messaging

- Gather block-by-block rent comps

- Advise on finishes, amenities, and pre-leasing strategies

- Build the pre-opening marketing funnel

- Set leasing pricing cadence

- Prepare model units and staging strategy

- Develop advertising and ILS rollout

- Prepare the onsite or remote leasing team

Southwest Equity Partners often begin consulting months before the first unit is completed, ensuring the lease-up starts with momentum.

4. The Lease-Up Blueprint

Here is a detailed sequence of a successful lease-up tailored for San Diego properties.

Market Research & Rent Positioning

Firms begin with extremely granular analysis such as micro-market comparables, $/SF patterns, competing lease-ups in the pipeline, amenity premiums, renovation influences, lease expiration timing and local economic drivers

This creates a customized rent recommendation as opposed to a generalized “market range.”They want identity, community, and a sense of place. Firms can help guide logos and identity (if desired), property description language, unique selling points, photography and creative direction, digital presence and SEO content.

This is especially critical for smaller boutique assets competing with big-box new construction.

Pre-Leasing Timeline & Marketing Launch

Most successful lease-ups begin around 60 days before the first unit is ready.

This includes high-quality photography or renderings and visuals, ILS listings (Zillow, Apartments, etc.), Google business set up, and website or landing page for early lead capture. This early momentum is a major competitive advantage for small properties.

Pricing Strategy & Release Cadence

One of the biggest mistakes in small lease-ups is releasing all units at once.

Avoid this by releasing units in waves, testing pricing for early demand and adjusting based on lead velocity, monitoring competitor concessions and optimizing for unit mix absorption.

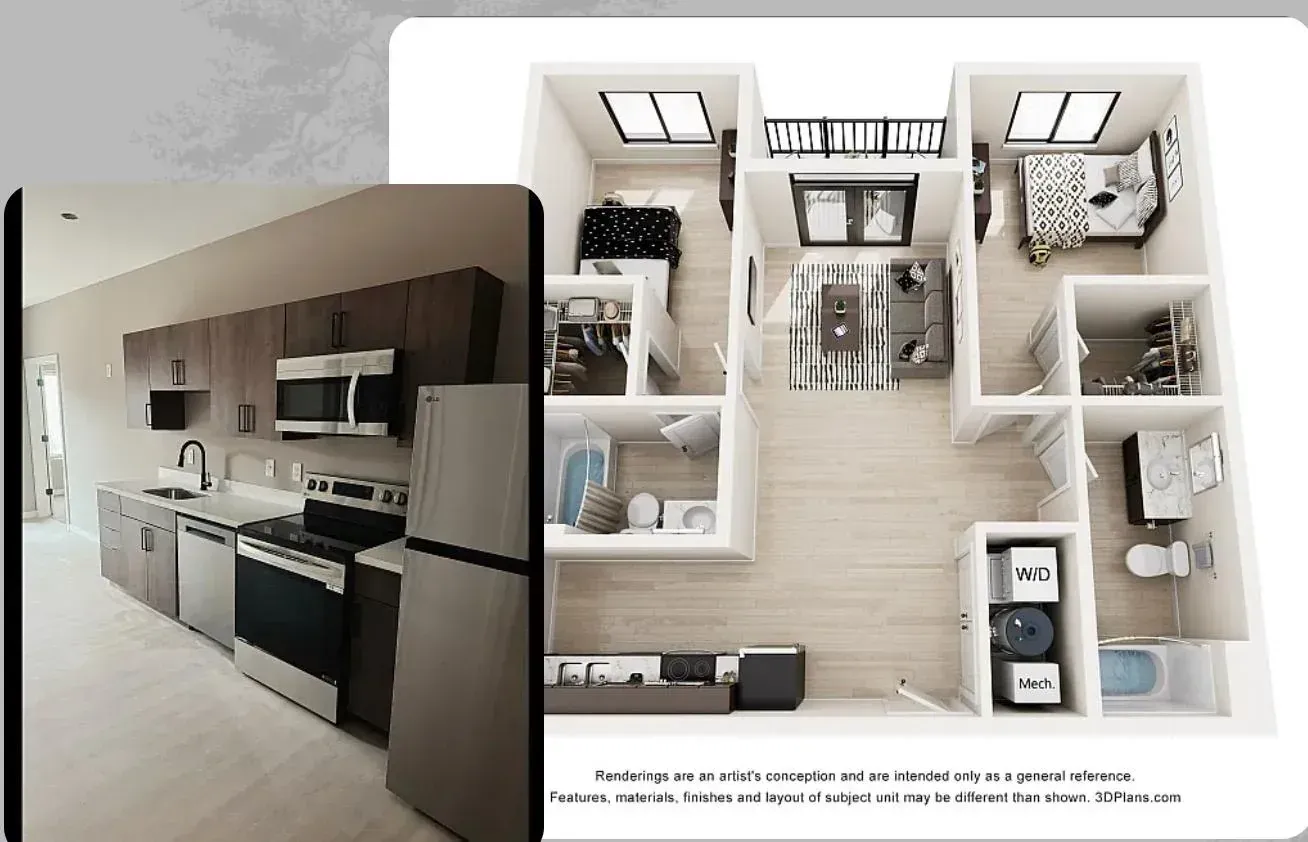

Model Unit Design & Onsite Experience

Even small properties benefit from a curated onsite experience.

Recommendations include: one staged model unit, if possible, branded signage and light staging, weekend accessibility, and strong customer service.

These influence both absorption and renewal likelihood.

Leasing Funnel Optimization

This includes fast response times, text + email follow-up sequence, scheduled tours within 24 hours, real time price adjustments and clear communication from first contact to lease signing.

Small boutique teams can focus on proper attention and follow up.

Resident Experience & Early Renewal Strategy

Lease-up success isn’t just about initial occupancy - it sets the tone for years.

Boutique firms focus on warm welcome packets, personalized onboarding, timely maintenance response, community engagement touchpoints, and proactive renewal planning.

Good early experiences create renewal stability which is critical for smaller properties.

Stabilization & Ongoing Operations

Once the property reaches 90–95% occupancy, the job isn’t done.

Management continues to optimize:

- Seasonally adjusting renewal pricing

- Reviewing operating expenses

- Monitoring tenant behavior

- Managing delinquencies

- Implementing preventative maintenance

- Creating year-one owner reports

- Preparing investor-ready financials

This ensures your building transitions from “leased up” to “long-term profitable."

5. Common Mistakes Owners & Developers Make in Lease-Ups

Avoid these common pitfalls:

- Waiting too long to hire a property manager - Waiting until construction is nearly complete reduces rent potential and slows absorption.

- Choosing a large property management company – Many do not customize strategies for smaller properties.

- Mispricing units during the first 30 days - Underpricing leaves money on the table. Overpricing destroys momentum.

- Releasing all units at once - Staged release = higher rents + better absorption.

- Poor marketing assets -Low-quality photos or inaccurate descriptions hurt conversions.

- Slow lead response - Renters move fast. Make sure your leasing team has multiple touchpoints throughout the renter’s journey.

- No renewal or retention strategy - Early resident experience determines long-term stability.

Boutique firms are built to avoid these mistakes.

6. Final Thoughts: Smaller Buildings Require Big Strategy

Lease-ups for many San Diego properties are not a scaled-down version of institutional operations. They are a different discipline entirely.

Success requires:

- Micro-market expertise

- Decisive management

- Tailored marketing

- Precise pricing

- Hands-on leadership

- Resident-first experiences

Property management firms like Southwest Equity Partners are uniquely equipped to deliver all of these.

Reach Out to Us

If you’re developing or repositioning your property, your lease-up strategy will define your long-term success.

- Southwest Equity Partners offers a complimentary Lease-Up Strategy Consultation, including:

- Rent positioning analysis

- Neighborhood competition study

- Marketing plan

- Unit mix review

- Pre-leasing roadmap

👉 Request your free consultation

Let’s position your new property for a strong, profitable launch.